Welcome to the second quarterly Yorkshire Commercial Property Review of 2023 by Bradley Hall.

The analysis will provide you with an in-depth overview of the county’s commercial property market, helping you to make more informed decisions when making your next investment and when planning for the future.

“Yorkshire’s thriving advanced manufacturing and logistics industries, coupled with its growing reputation as a financial and professional services hub, has led to the county’s commercial property sector continuing to thrive over recent months, with investor confidence remaining above the UK average and developers continuing to capitalise on increasing appetite from both the public and private sectors to ‘north shore’ their operations. It really is an exciting period for the everyone associated with the industry."- David Cran, Managing Director, Bradley Hall Yorkshire and North West

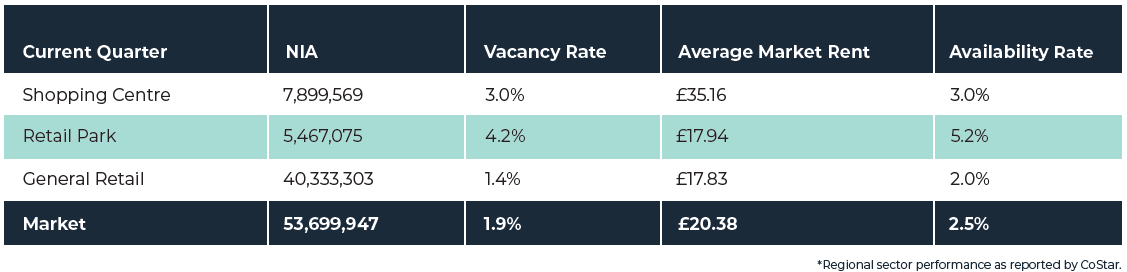

Retail

Leeds’s retail market comprises the metropolitan county of West Yorkshire, the second most populous urban area in northern England and one of the largest in the UK, with a population of 2.4 million. Its substantial size and buying power potential make it one of the nation’s most important retail centres. Leeds is home to 54.2 million SF of retail space, equating to about 22 SF per capita, which is in line with the UK national average.

The effects of the pandemic and the cost-of-living crisis on Leeds’s retail market are expected to linger. Retail and recreation footfall in Leeds was still down around 10% on its pre-coronavirus baseline in October, which was broadly in line with Manchester but a stronger recovery than London (-21%), according to Google’s mobility trends. Another headwind facing retailers is persistently high inflation, which is dampening consumers’ propensity to spend (the GfK Consumer Confidence indicator remains near its historic low at -45 in January 2023).

Leeds’s retailing environment has softened since the pandemic, with annual net absorption flat and the vacancy rate trending upwards, albeit it remains at a low level. Notable store closures include Debenhams, Topshop and the Disney store, all at the White Rose Shopping Centre; Debenhams on Briggate, Timberland on Albion Street and Thorntons on Commercial Street, all in the city centre; and Peacocks at Kirkstall Bridge Shopping Park.

Discount and value retailers have been involved in most of the larger new openings over the past 12 months. Most recently Primark has taken 55,000 SF at the Broadway Bradford - at the store formerly occupied by Debenhams, which has been vacant since 2021. They will be relocating from the nearby Kirkgate Store after Bradford Council bought the Kirkgate Centre with a view to repurposing the site in the coming years. Other examples include The Range taking 46,500 SF at Pellon Lane, Halifax, Dunelm taking 18,300 SF at The Springs in Leeds and Easy Bathrooms taking 20,000 SF at Beck Retail Park in Wakefield.

Property owners are also looking to repurpose vacant space. In January, Gravity Entertainment signed 23,000 SF at Xscape in Wakefield and Nuffield Health took 38,000 SF at Otley Road in Bradford.

Investment activity has slowed in recent months as interest rates and debt costs have soared. Several shopping centres changed hands in early 2022 – most notably Leeds Victoria Gate and Victoria Quarter – albeit at prices well below what they were once worth. HIG Capital and Bride Hall Group sold Kirkgate Shopping Centre, Bradford to the City of Bradford District Council for £15.5m reflecting a net initial yield of 9%. Market sources report that its acquisition and subsequent demolition will enable the council to double the size of its plans for a new urban village, including 1,000 homes.

In August Frasers Group bought the former Debenhams Store on Briggate, Leeds for £40 million from Orchard Street Investment Management. Earlier in the year, buyers were showing a strong preference for retail assets perceived to be defensive such as supermarkets and retail warehouses tenanted by “essential” retailers, although this activity has slowed given the current slowdown. Average yields have moved sharply outwards over the past couple of years amid the structural shift in shopping patterns and uncertain occupational backdrop.

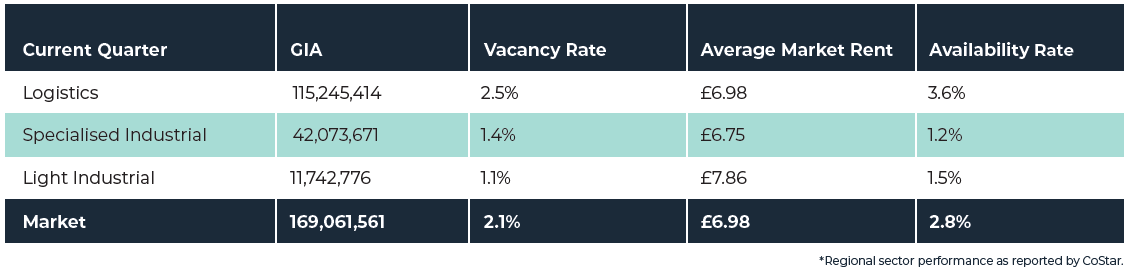

Industrial

Yorkshire hosts one of the UK’s largest and most dynamic industrial markets, aided partly by its links to the M62 and M1 motorways. As well as serving as a key logistics hub, it is home to one of the UK’s largest clusters of manufacturing businesses, which generate around 12% of the Leeds City Region’s economic output. Significant warehouse occupiers include Amazon, Marks & Spencer, Coca-Cola and The Range.

Industrial occupier market conditions have fallen back from the heady levels of the past few years. That said, vacancies are currently at 2.1% having trended below the UK national average since 2015 and remain among the lowest of the nation’s industrial markets with 100 million SF of stock or more.

Melburg Capital has recently prelet 210,000 SF Voltaic, Wakefield 41 to XPO Logistics, which is currently under refurbishment. Otherwise mid-box has been the most active market, with lettings to the likes of WH Malcolm, Sigma Retail Solutions and Dawson Group. These have replaced big-box lettings by the likes of Amazon, Next and Easy Bathrooms, agreed during the pandemic. Meanwhile, at the smaller end, vacancy rates on Leeds’s multi-let estates has increased but remain low historically. Although tapering down, rental growth remains strong, particularly in industrial estates near Leeds city centre, with access to the motorway network.

On the investment side, activity has slowed sharply, given the economic outlook and sharp rise in interest rates. Investment volumes have amounted to £175 million over the past 12 months, which compares to a record £1 billion in 2021 and the five-year average of £459 million. Sales activity in recent months has been from purchasers looking for long income, value add opportunities and vendors needing to release funds. This includes international private equity real estate firm Cabot Properties buying Leeds’ Prima House industrial warehouse from First World Hybrid Real Estate for £8 million and Morrisons Supermarkets, who sold seven logistics properties across the UK in December.

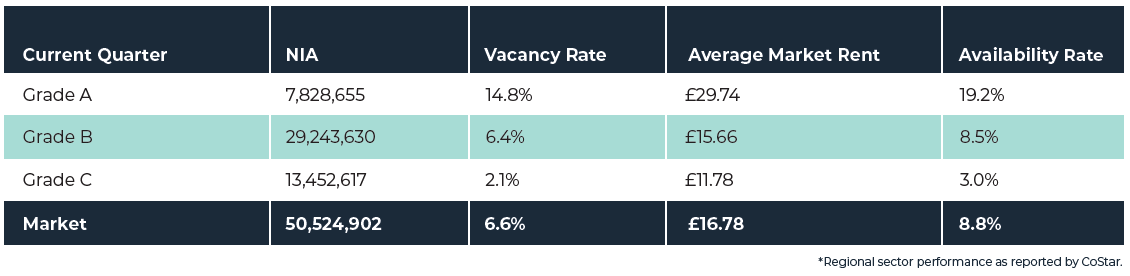

Office

Yorkshire’s sizeable financial and professional services sector, coupled with its growing reputation as a tech and media hub, has supported demand for office space and boosted confidence among market participants in recent years. While leasing has slowed since the pandemic started, there have been some sizeable transactions agreed in recent months, including one of the largest lettings in recent years, 138,500 SF to Lloyds Bank at 11-12 Wellington Place in Leeds.

Investment into Leeds’s office market has cooled down since the onset of the pandemic, especially in recent months, in response to rising interest rates and debt costs. Yields are moving out, and annual volumes (£62.4 million) are down sharply on the £600 million invested in 2018 and 2019 but compare more favourably to the market’s long-run annual average (£303 million). Among the few substantial transactions since last autumn was the sale of grade A 2 City Walk in March, which offered the potential for a reversionary rental uplift. David Samuel Properties purchased the building for £10.5 million and despite the low passing rents of £20.00 to £22.38/SF, there is significant potential for reversion and increased rental income.

Although vacancies have crept up to 6.6% amid occupiers’ consolidation (and are expected to rise further with negative net absorption and as new supply delivers), CoStar’s Base Case forecast scenario calls for them to remain below those of other Big Six office markets and the UK overall. The market’s demand base remains diverse, with technology, finance and professional services, education, and flexible workspace firms all involved in notable lettings over the past 12 months. Net absorption has, however, been negative over the past 12 months, as firms have reduced their office footprints amid the shift to more flexible ways of working. Large blocks of space have been offloaded by companies in the finance and energy sectors in recent quarters.

Rising vacancy is putting downward pressure on rental growth, which has slowed to 0.9% year-over-year and is expected to fade further in the coming months in line with rising supply. Average office rents in Leeds (£16.90/SF) are among the lowest in the Big Six, and some developers are taking advantage of the upside potential of refurbishment projects, particularly in the City Core near Channel 4’s headquarters and ongoing improvements to Leeds’s railway station. Prime headline rents in the city centre stand at £36/SF, which is also lower than other Big Six office markets.

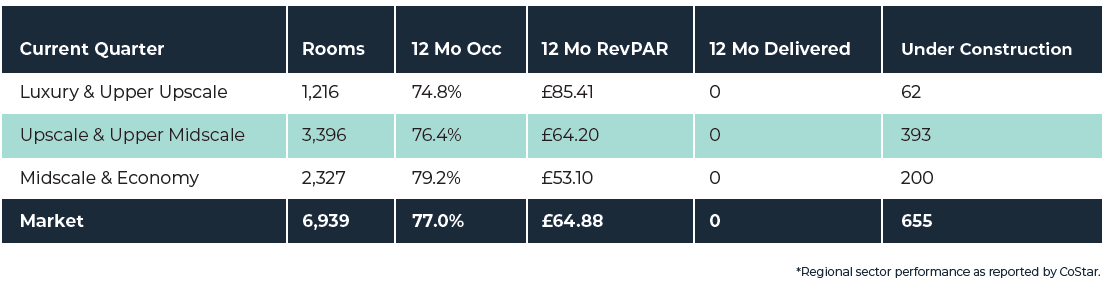

Licensed & Leisure

May results point to a robust first half of 2023 in Yorkshire. Occupancy levels are broadly in line with pre-pandemic while rates are well ahead, up by 25% on 2019 levels, also posting strong uplifts year-over-year (up 19%) as demand growth has remained largely positive, also bolstered by the UKREiiF conference in May. Consumers continue to favour experiences over goods, thus benefitting the hospitality sector still. There are downside risks, however, as a slowdown could come further down the line, especially from a leisure perspective, given higher living cost pressures.

Leeds has established itself as an events and leisure destination following regeneration projects, including the opening of the First Direct Arena in 2013. The city is well connected to other parts of the UK and internationally through its rail links and airport, attracting a high proportion of domestic visitors. Further investment to the city’s infrastructure will benefit rail transport links, including an upgrade to Leeds Train Station, a new station at White Rose Centre.

Robust pent-up demand returned to Leeds, particularly from a leisure perspective. Leeds has been one of the better performers coming out of the pandemic and one of the few regional markets to see positive RevPAR growth on 2019 levels from February onwards. To date, weekend performance has continued to lead the city’s performance recovery, though the return of the corporate segment is also translating into midweek improvements, with weekday metrics trending ahead of those seen pre- pandemic.

Corporate demand, supporting weekday room nights, is largely led by key sectors present in the city such as technology, finance and professional services with many having recently downsized their office footprint amid the shift towards more flexible working arrangements, affecting corporate room nights locally. Government business is also prominent in the city, especially since tour groups from Asia are still missing, thus increasing the share of contracted room nights, which tend to be lower rated too.

Events support the local market, generally, especially arena-led ones. The city’s calendar of events looks generally busy this years. Past festivals have already had an impact, such as Slam Dunk during the last bank holiday weekend in May, while future festivals, such as Leeds Festival during the last August bank holiday, should also make the city busy. Meanwhile, the Headingley Cricket Ground in Leeds will host The Ashes in the beginning of July, also influencing forward- bookings, and therefore expected to support hotels locally.

Limited supply should support the market’s recovery this year. However, there are currently 4 projects under construction, representing a 9.4% share of the existing stock, which could affect the market’s performance once these are open. In 2024, Hyatt is expected to add its first property to the city with the opening of the 305-room Hyatt Place and Hyatt House Sovereign Square. Interstate Hotels & Resorts is expected to manage the dual-branded property featuring meeting rooms, an on- site gym, a groundfloor restaurant and a bar extending into the public square, plus an independent rooftop bar with a dedicated entrance.

Indicative of the current environment, hotel sales have been limited over the past 12 months. The city has experienced higher levels of investment than other regional markets, however. Similar to the wider national trend, well-capitalised owners have been purchasing properties, including Pandox’s acquisition of the 232- room Queens Hotel for around £53 million (£228,000/room).

*As reported by CoStar

Sign up to our mailing lists to stay up to date with the latest news here