Welcome to the first Yorkshire Commercial Property Review of 2023 by Bradley Hall.

Over the next few pages, we will provide all of the insight and market research required to help you better navigate the regional landscape, as well as providing our expert analysis and predictions for the future of the industry.

“Continued inward investment into Bradford, Leeds and Wakefield – combined with the completion of key developments across most property sectors but notably residential and PRS schemes, large warehousing and logistics developments and ongoing infrastructure investment, have led to increased activity, and with more developments set to come to fruition over the coming months, it is certainly looking as though 2023 could be yet another stellar year for the sector.” - David Cran, Managing Director, Bradley Hall Yorkshire and North West.

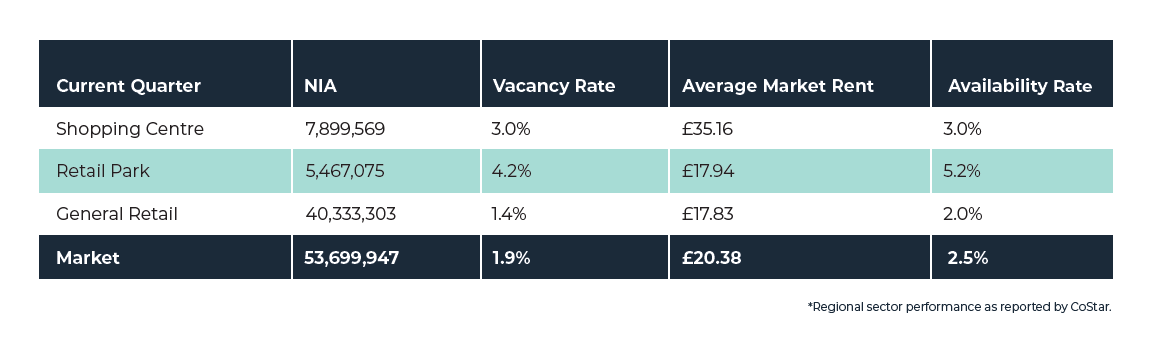

Retail

Leeds’s retail market comprises the metropolitan county of West Yorkshire, the second most popular urban area in northern England and one of the largest in the UK, with a population of 2.4 million. Its substantial size and buying power potential makes it one of the nation’s most important retail centres. Leeds is home to 53.6 million sq ft of retail space, equating to about 22 sq ft per capita.

Discount and value retailers have been involved in most of the larger new openings over the past 12 months across Leeds. Most recently Primark has taken 55,000 sq ft at the Broadway Bradford – at the store formerly occupied by Debenhams, which has been vacant since 2021. They will be relocating from the nearby Kirkgate Store after Bradford Council bought the Kirkgate Centre with a view to repurposing the site in the coming years. Other examples include The Range taking 46,500 sq ft at Pellon Lane, Halifax, Dunelm taking 18,300 sq ft at The Springs in Leeds and Easy Bathrooms taking 20,000 sq ft at Beck Retail Park in Wakefield.

Sheffield’s retail market comprises the county of South Yorkshire’s which has a population of 1.4million. Its four submarkets- the City of Sheffield, Doncaster, Rotherham and Barnsley- are home to 32.8 million sq ft of retail space, equating to approximately 22 sq ft per capita, which is slightly above the national average.

Most of Sheffield’s retail inventory is on the high street, with around 5.4 million sq ft in shopping centres and 3.9 million sq ft in retail parks. The Sheffield retail market, like others around the country, continues to face ongoing headwinds. However, some retailers will perform strongly, such as the discounters, as consumers switch to value brands.

Although the shift to hybrid working or working from home threatens certain subsectors. Leasing activity remains half of pre-pandemic norms and vacancies have increased 3.7% from around 2% at the beginning of 2020.

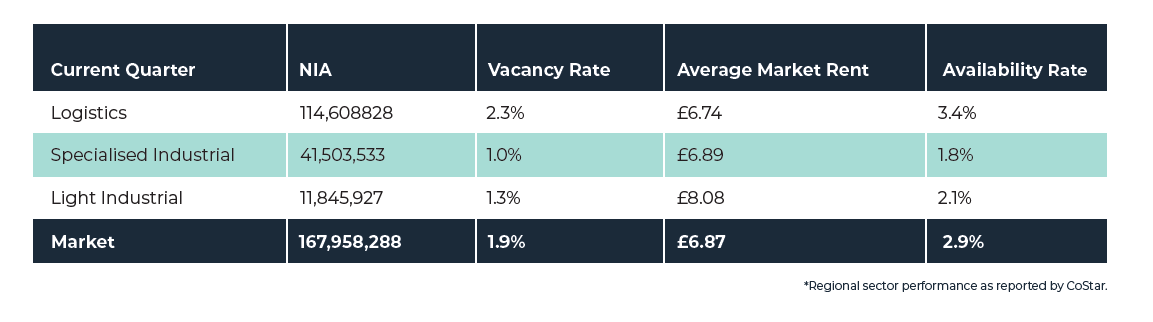

Industrial

Leeds hosts one of the UK’s largest and most dynamic industrial markers, aided partly by its links to the M62 and M1 motorways. As well as serving as a key logistics hub, it is home to one of the UK’s largest clusters of manufacturing businesses, which generate around 12% of the City’s Region’s economic output. Significant warehouse occupiers in Leeds include Amazon, Marks & Spencer, Coca-Cola and The Range.

Mid-box activity to logistics companies such as XPO and Vanguard Distribution have replaced big-box lettings in 2021 by the likes of Amazon, Next and Easy Bathrooms. Meanwhile, at the smaller end, vacancy rates on Leeds’s multi-let estates has increased but remains low historically, with rental growth remaining strong, and is particularly pronounced in industrial estates near Leeds city centre and benefitting from access to the motorway network.

Most of York’s larger distribution warehouses (100,000 sq ft+) are sited along the A1(M), which forms part of a 410- mile route connecting Edinburgh to London. Key industrial occupiers in York include Nestle, Saint-Gobain and Clipper.

While leasing activity has slowed in recent months, parcel companies were expecting their urban logistics presence in the region last summer. In July 2022, DPD signed a 30,000 sq ft pre-let at Northminister Business Park on the edge of York.

The majority of lettings have been below 10,000 sq ft over the past year. Monks Cross Business Park is one multi-let scheme that has proven popular, with several 2,800 sq ft lettings in October. In January Cygnet Resources Ltd signed for 1,550 sq ft at Mandale Park, Mount Pleasant Way in Stokesley near Middlesbrough where there are 27 new hybrid commercial units in a 2 storey configuration.

Sheffield’s location at the heart of the UK’s road network, together with its proximity to six airports and the Humber and Liverpool container ports make it an important industrial and logistics hub. Key warehouse occupiers in the local market include Amazon, B&Q and IKEA.

Occupier market conditions in Sheffield remain robust, with 2022 continuing the strong level of activity seen in recent years. Sheffield’s industrial vacancy rate is expected to remain fairly low and stable over the coming years even as supply ramps up. The market remains well-placed to outperform given supply-side pressures and high levels of demand.

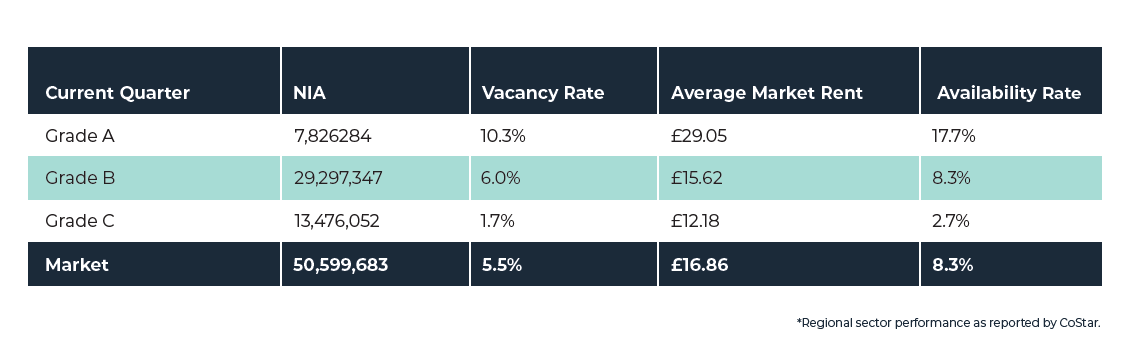

Office

York is a city of national importance, providing a wealth of cultural and historic attractions, which drive a thriving tourist industry. The city also supports a range of financial and insurance occupiers, of which Aviva, NFU Mutual, and Hiscox are the most prominent. York’s tenant mix has expanded in recent years to include technology-focused SME’s and startups.

Office occupier market conditions in York remain relatively strong in the face of the shift to working from home or hybrid working patterns. Although the vacancy rate (currently 3.9%) has risen following several quarters of negative net absorption and supply additions, it remains well below its historical average (8.3%) and the current UK national average (7.5%).

In spite of the structural challenges to offices, the Sheffield market continues to perform relatively well. Although the vacancy rate is rising, on account of negative net absorption and supply additions, it remains comfortably below its historical average and the UK national average.

There were some notable transactions last year across Sheffield, including BT Group’s 63,000 sq ft letting of the speculative Endeavour building and SBB Law’s letting of 43,000 sq ft at 1 South Quay, both in Sheffield city centre and the biggest deals since the pandemic started.

Leeds’ sizeable financial and professional services sector, coupled with its growing reputation as a tech and media hub, has supported demanded for office space and boosted confidence among market participants in recent years. While leasing has slowed since the pandemic started, there have been some sizeable transactions agreed in recent months, including one of the largest lettings in recent years, 138,500 sq ft Lloyds Bank at 11-12 Wellington Place.

The market’s demand base remains diverse, with technology, finance and professional services, education, and flexible workspace firms all involved in notable lettings over the past 12 months.

Investment

Similar to activity nationally, investment volumes across York industrial spaces have slumped since the spring as investment rates and debt costs have risen. However, thanks to strong activity earlier in 2022, record volumes were recorded at more than £155 million. In September Banfa Properties Ltd purchased 4-6 Ashbrooke Park from Catella APAM for £% million, reflecting a Net Initial Yield of 5.3%. The 51,029 sq ft unit is let to Kinnerton (Confectionery) Ltd. showcasing a positive trend for 2023.

Several shopping centres changed hands across Leeds in early 2022 – most notably Leeds Victoria Gate and Victoria Quarter – albeit at prices well below what they were once worth. HIG Capital and Bride Hall Group sold Kirkgate Shopping Centre, Bradford to the City of Bradford District Council for £15.5m reflecting a net initial yield of 9%. Market sources report that its acquisition and subsequent demolition will enable the council to double the size of its plans for a new urban village, including 1,000 homes.

York office space trading has been dominated by lower value transactions such as 11-13 St Saviours Place, York, which sold for £1.6 million in October 2022. Across Sheffield the pandemic cooled investment activity, but 2022 has been even quieter than recent years - £30 million compared to less than £100 million changing hands for a third successive year in 2021 (sales volumes averaged nearly £200 million annually from 2016-18). Among the most significant transactions in 2022 was CEG’s sale of the long leasehold in 1 North Bank, Sheffield to Regional REIT for £8.5 million in June, reflecting a net initial yield of 8.94%

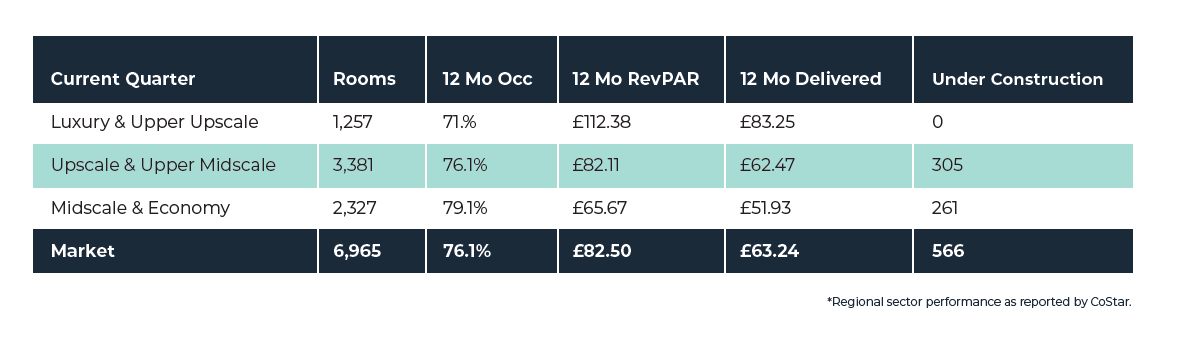

Licensed & Leisure

Leeds is well placed to capture domestic leisure demand having seen a recovery since 2021, helped by limited supply additions, while it will also benefit from major events in the coming months. CoStar’s latest forecast estimates RevPAR to grow by 5% this year on 2022 results, 16% ahead of 2019 levels, mainly driven by gains in occupancy.

Leeds has established itself as an events and leisure destination following regeneration projects, including the opening of the First Direct Arena in 2013. The city is well connected to other parts of the UK and internationally through its rail links and airport, attracting a high proportion of domestic visitors. Further investment to the city’s infrastructure will benefit rail transport links including an upgrade to Leeds Train Station, a new station at White Rose Centre.

The northern city has been one of the better performers coming out of the pandemic and one of the few regional markets to see positive RevPAR growth on 2019 levels from February onwards in 2022. RevPAR results from the previous year-end saw uplifts of 11% against 2019 results.

Limited supply in the next two years should support the market’s recovery. There are two hotel projects under construction, following a slowdown in construction as the pandemic hit. The Wellington Place hotel, due to open in 2025, will be part of the part-completed Wellington Place, a new urban quarter with office, retail, leisure and residential development, and it is expected to offer 200 rooms. Meanwhile, in 2024, Hyatt is expected to add its first property to the city with the opening of the 305-room Hyatt Place and Hyatt House Sovereign Square. Interstate Hotels & Resorts is expected to manage dual-branded property featuring meeting rooms, an on-site gym, a groundfloor restaurant and bar extending into the public square, plus an independent rooftop bar with a dedicated entrance.

New to the market for Q2

Searching for a new commercial property to buy or rent?

Below are some of the newest properties to have hit the market for Q2

Ground Floor, Springwell Gardens, Whitehall Road, Leeds

Price on Application

Size: 1023 - 4037 sq ft

To find about more about this property contact Bradley Hall Leeds via leeds@bradleyhall.co.uk or call 0113 223 4868