Bradley Hall saw sales and lettings continue to stand firm during the fourth quarter of 2022, despite the economic uncertainty which buffeted the market. In this report, we break down the most significant deals completed during the quarter, as well as taking a look at the kinds of deals and property that piqued the interest of investors most. We also outline our early predictions for the market in 2023, which – if early indicators are a sign of things to come - will offer opportunities aplenty for astute investors.

“Confidence in the North East property market remains high. It’s been a tough period for both people and businesses alike, but we’re finding that people still see the region as a great place to invest and there remains plenty of great commercial opportunities for those seeking to capitalise on falling prices and fantastic one off opportunities.” – Richard Rafique, Managing Director – Commercial

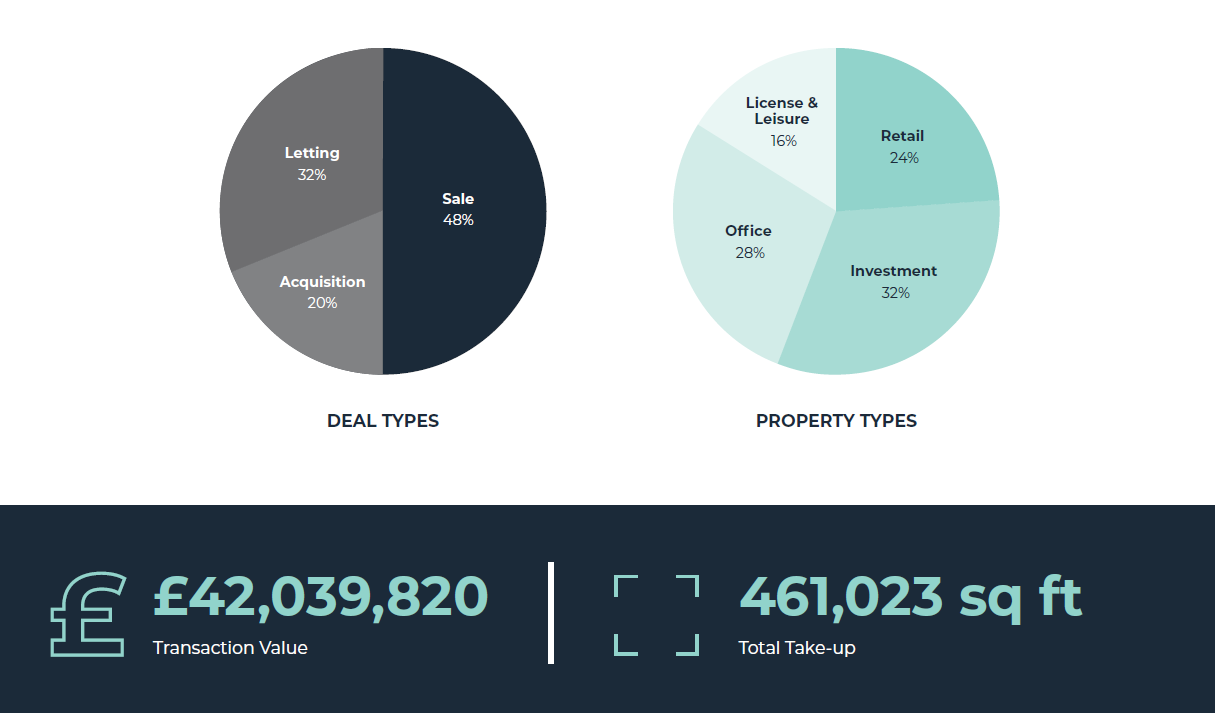

Bradley Hall – Q4 Breakdown

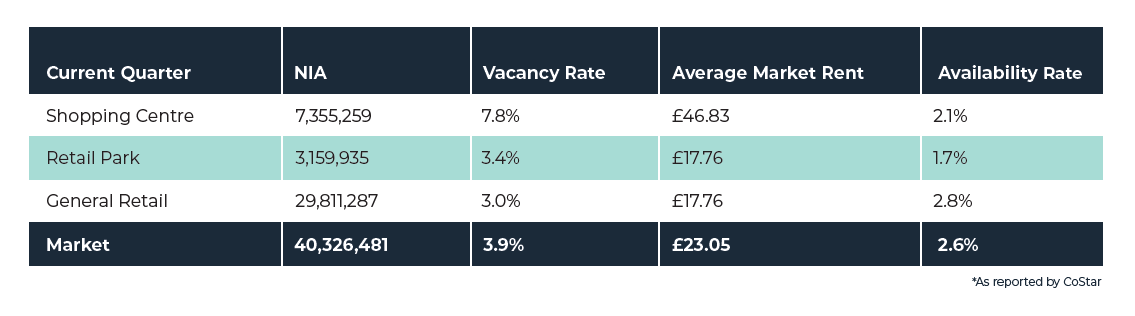

Retail

The North East, like the rest of the UK, has faced challenges across the retail sector in recent years. However, throughout Q4 of 2022 retail has offered positive indicators for a more buoyant future. Newcastle contains 40.3M sq ft of retail space, equivalent to around 27 sq ft per capita, which is above the national average. Although vacancies have risen and discounts on leases have also grown, these changes have opened the market to softer pricing, resulting in certain buyers being brought back to the table keeping the retail market across the North East moving. Opportunities have been presented to more local, independent, niché businesses and those offering premium goods. Demand remains high for convenience, roadside, health, and lifestyle operators. Retail warehouses let to discounters and food stores remain favoured for the perceived defensiveness in the current climate.

Regional sector performance as reported by CoStar: Deals: 125 Value: £146,000,000 The top retail deals completed by Bradley Hall during the fourth quarter of 2022:

22-22a Silver Street, Durham Price: £95,000.00 Size: 2,945 sq ft Deal: Letting Client: Deal complete on behalf of clients

Asprey House, St Georges Terrace Price: £40,000.00 Size: 2,217 sq ft Deal: Letting Client: Watermark Investments

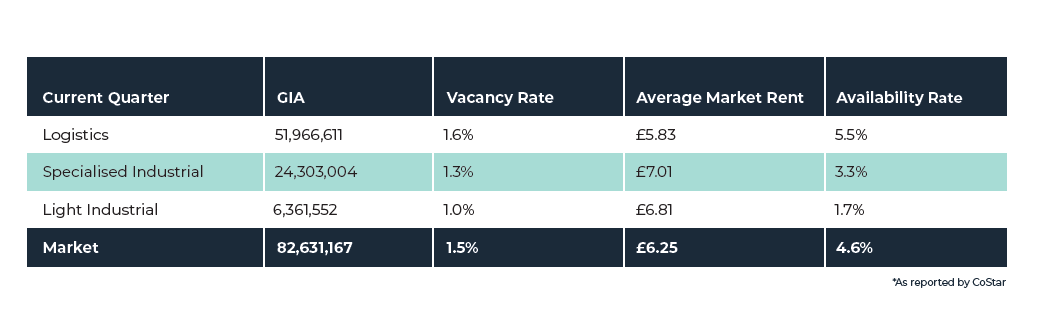

Industrial

Industrial market conditions in Newcastle remain tilted in landlord’s favour. Vacancies have fallen by 1.5%, helped by limited speculative development.

Leasing activity has slowed over the past couple of quarters, however, amid the cost-of-living crisis and weakening economic landscape.

Tight vacancy has kept rents moving upwards over the past several years, with rent growth accelerating into late 2022. Although growth is running at an elevated rate (9.5% year-over-year), Newcastle remains one of the nation’s weaker long-term performers with 10-year average annual rent growth of 4.0% (versus the national index’s 5.4%). In line with slowing demand, rental growth is expected to cool as occupiers’ cost bases are put under pressure and property expansion plans get put to one side. Some occupiers might be inclined to pay higher rents if moving premises enables them to mitigate other expenses, however.

Although the macroeconomic environment has worsened in recent months, industrial market conditions in Tees Valley & Durham continue to favour landlords. The vacancy rate (currently 3.5%) has drifted steadily downwards over the past three years, with 12-month net absorption of 1.4 million SF met by 1.1 million SF of annual net completions in that time.

Amazon’s expansion is perhaps the local occupier market’s most notable success story. The online giant’s third fulfilment centre will open soon, taking its Tees Valley & Durham distribution footprint above 6 million SF. Plans for a fourth regional hub at Teesside International Airport are on hold, however, following the firm’s decision to scale back its expansion. The e-commerce giant has been drawn to the area by its road and port connections as well as comparatively affordable rents labour, and government incentives.

Fuelled by tight vacancy and broad-based demand, average industrial rents in Tees Valley & Durham are rising strongly. They have grown by 13.1% over the past 12 months, placing the market among the country’s top performers.

Office

Office space remains a favourable market across the North East. Although this is more specific to the top end of the market and what is considered Grade A. Newcastle hosts big-name office tenants like EE, Sage, Santander and all of the ‘big four’ professional service firms. Occupiers’ desire for the best-in-class space has led to strong demand for new and forthcoming schemes in the city centre and Riverside Sunderland, while some of the biggest spaces to become vacated have been reabsorbed.

HMRC’s commitment to a 460,000 sq ft regional hub at Pilgrim’s Quarter has further boosted confidence in the local office market. Although Newcastle’s vacancy rate (currently 7.4%) is higher than it was at the onset of Covid-19, the effects of the shift to hybrid working have been less pronounced here than in most other larger regional office markets.

That said, take up in 2022 totalled 239,410 sq ft and headline rents at schemes such as Bank House are expected to reach £30 per sq ft in 2023. Although speculative, construction has picked up across the office market, the three schemes underway had about 200,000 sq ft of space available as of November 2022. Tees Valley and Durham’s local authorities have set out to change the low levels of inward investment for funding new developments for office space, further suggesting a desire to meet the demand for office space.

Regional sector performance as reported by CoStar: Deals: 68 Value: £84,500,000

Signature House, Doxford Park, Sunderland Price: £950,000 Size: 2,250 sq ft Deal: Sale Client: Kevin Wilde

Esh Group Annexe Facility, Bowburn Price: £390,000 Size: 3,400 sq ft Deal: Sale Client: Esh Holdings Limited

Investment

It is forecast that inflation and energy rates will stabilise in 2023 which will generate more investment activity.

Some distress is expected which will result in increased transactions. Opportunistic investors with access to finance are awaiting opportunities with the expectation of price reductions. Investors are expected to focus more on the ability of covenants to perform and meet lease obligations, as opposed to capital growth. Multi let assets still remain in favour as they diversify risk.

Regional sector performance as reported by CoStar. The top investment deals completed by Bradley Hall during the fourth quarter of 2022:

1 Factory Road, Blaydon on Tyne Price: Undisclosed price Size: 21,631 sq ft Deal: Acquisition Client: Private Individual NIY: 6.48%

Quorum Retail Parade, Quorum Business Park, Newcastle Price: £1,500,000 Size: 9,892 sq ft Deal: Sale Client: Northumberland Estates NIY: 8.43%