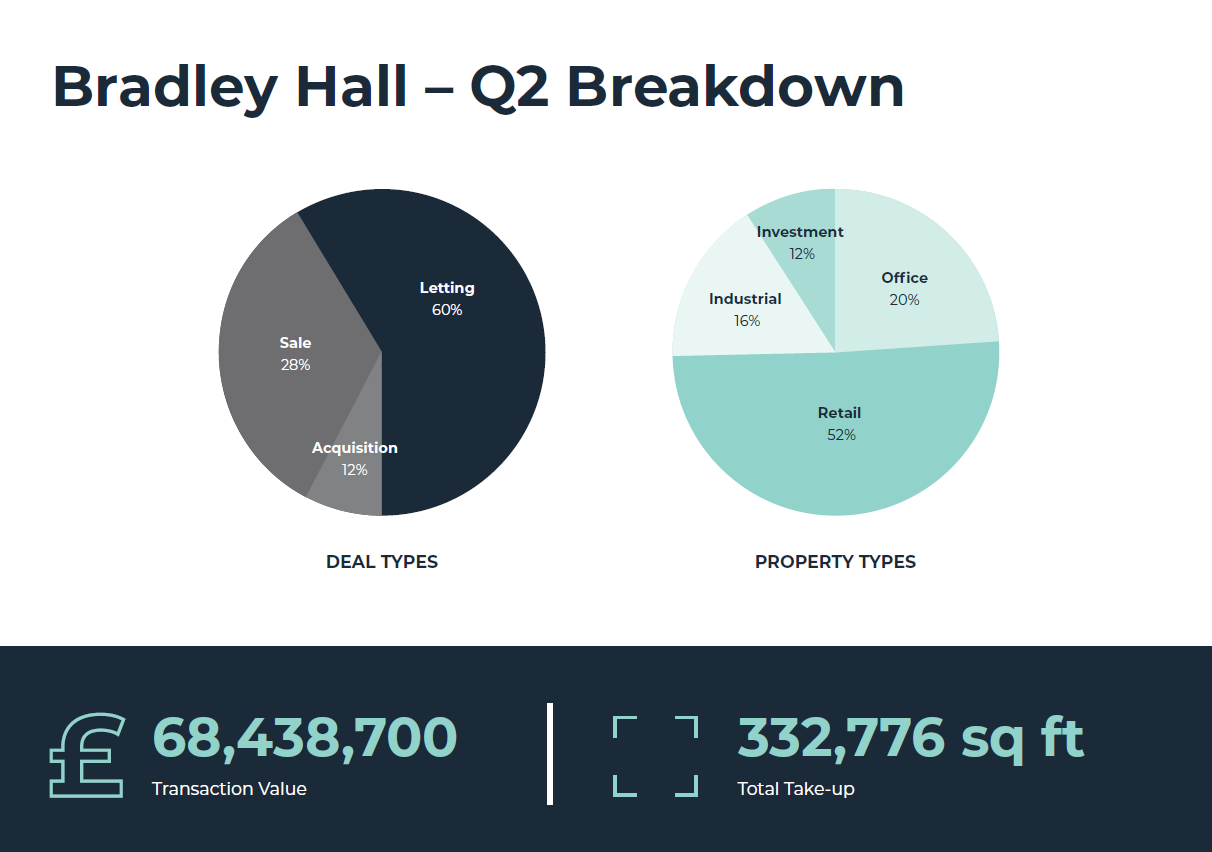

Bradley Hall saw sales and lettings rise during the first quarter of 2023, despite rising interest rates and increasing talk of a market slowdown.

In this latest Market Performance report, we highlight the most significant deals completed during the quarter, as well as taking a look at the kinds of deals and property that led to this increase in activity across each of our core sectors.

We will also outline our predictions for the second half of 2023, which – if it continues in the same fashion as H1 - will be sure to offer opportunities aplenty for astute investors looking to grow their portfolios and make significant gains.

“Cranes seem to have dominated the skylines of our key cities throughout this year. From Strawberry Place to Riverside Sunderland, Millburn Gate and TeesAMP, the North East is undergoing a regeneration programme not seen in generations. Not only is this leading to increased investment in our urban core, but the investment is also rippling throughout the region, with demand for quality housing and workspace increasing as a result, leading to a buoyant market for investors.” – Richard Rafique, Managing Director – Commercial

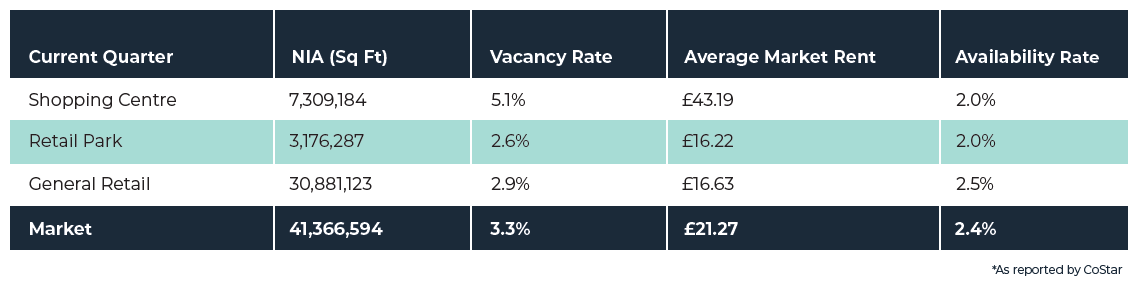

Retail

While Newcastle’s retail market has been visibly impacted by the pandemic, market conditions have improved in recent quarters. Vacancies have fallen from their peak, helped by rising demand from non-traditional occupiers including the public sector and leisure operators.

Robust tenant demand for retail parks is offering further support to occupancy levels. Natuzzi, Dreams and NCF Living signed up for flagship stores totalling 25,000 SF at Metro Retail Park in early 2023. Demand for city centre shops has been weaker, with vacancies in the city’s traditional retail core standing at nearly double the market-wide average at the end of June 2023.

The redevelopment of redundant retail space will be key to bringing vacancies down further. Plans were recently submitted to transform 36–40 Clayton Street in the city centre into an aparthotel, while a former Toys R Us store was knocked down to make way for the new units at Metro Retail Park in late 2022. Newcastle’s retail construction pipeline comprises mainly retail warehouses and food stores.

While investor sentiment towards the retail sector is weaker than it once was, appetite is polarised. Supermarkets are favoured for their perceived defensiveness in the current climate, while softer pricing has brought some buyers back to the table for shopping centres and properties on the high street. Investment volumes have amounted to £78.1 million over the past 12 months, down from £160 million a year earlier. Ongoing uncertainty and high interest rates are expected to continue to weigh on activity in the months ahead.

Newcastle city centre stands to benefit from a £40 million council-led initiative to improve the public realm on key retail thoroughfares. Grey Street and Northumberland Street are being made more people-friendly with wider pavements and greenery, while the nearby Ridley Place and Saville Row have been upgraded to serve as outside dining areas. The area around Pilgrim Street is likely to be rejuvenated once the UK government moves its 9,000 staff to a purpose-built campus in 2027.

The top retail deals completed by Bradley Hall during the second quarter of 2023:

8-9 Sandison Court, Brunswick Ind Estate

Price: Undisclosed

Size: 2,452 sq ft

Client: Undisclosed

Comms House, Hylton Road, Pennywell Industrial Estate, Sunderland, SR4 9EN

Price: Undisclosed

Size: 4,469 sq ft

Client: Undisclosed

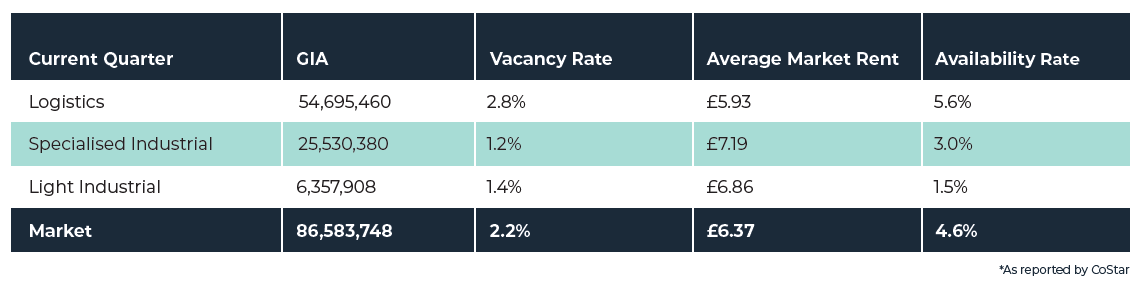

Industrial

The North East’s industrial market benefits from access to three deep sea ports and a diverse demand base. Whilst it is perhaps most renowned for Nissan—the carmaker supports 40,000 jobs through its Sunderland plant and the automotive supply chain—other advanced manufacturing subsectors, logistics and the energy industry make up a sizeable portion of its tenant mix.

Industrial market conditions remain tilted in landlords’ favour. Vacancies have fallen to 2.2%, thanks to multiple years of positive net absorption and limited speculative development. Small- to medium-sized warehouses sized from 20,000–50,000 SF have been the focus of activity in recent quarters, with distribution and manufacturing firms particularly active. The region has the potential to become a key hub for electric vehicle battery manufacturing – despite the collapse of Britishvolt - following a major commitment by Nissan.

Tight vacancy has kept rents moving upwards over the past several years, with rent growth accelerating into mid-2023. Although growth is running at an elevated rate (9.3% year-over-year), Newcastle remains one of the nation’s weaker long-term performers with 10-year average annual rent growth of 4.2% (versus the national index’s 5.7%). In line with slowing demand, rental growth is expected to cool as occupiers’ cost bases are put under pressure and property expansion plans get put to one side. Some occupiers might be inclined to pay higher rents if moving premises enables them to mitigate other expenses, however.

On the investment side, transaction activity has cooled amid ongoing market volatility and higher interest rates. Property companies have driven volumes in recent months, while funds have retrenched following a spike in redemptions following September’s ‘mini’ budget chaos. Sales volumes have amounted to £57.3 million over the past 12 months, down from £101 million a year earlier.

The top industrial deals completed by Bradley Hall during the second quarter of 2023:

Durham Rd, Bowburn, Durham DH6 5PF

Price: Undisclosed

Size: 200,343 sq ft

Client: Ward Group Investments

Unit F, Bridge End Industrial Estate, Hexham, NE46 4DQ

Price: £15,500 per annum

Size: 1,700 sq ft

Client: Undisclosed

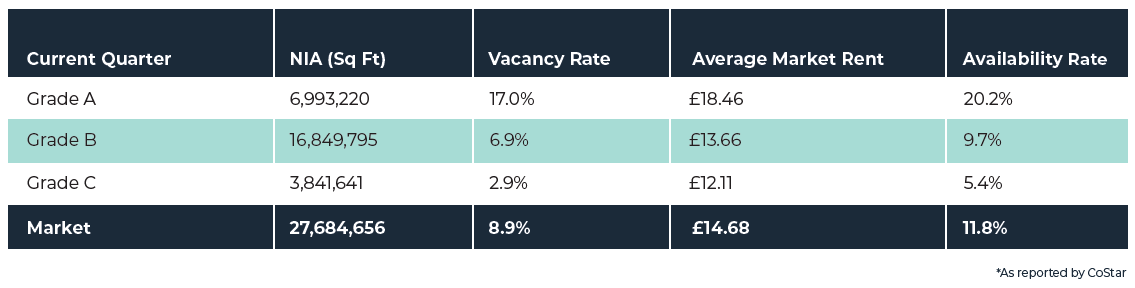

Office

With a sizeable population of 1.5 million, a diverse economic base and relatively affordable occupational costs, Newcastle hosts big-name office tenants like EE, Sage, Santander and all the ‘big four’ professional services firms. It also has an established legal sector and is home to fintech and life science clusters. Alongside the central business district and some of the nation’s largest out-of-town office parks, major regeneration projects in Sunderland and Gateshead have created new focal points for office demand.

Newcastle’s office vacancy rate is rising after a period of relative stability. Like other office markets across the country, demand is polarised between the best-quality offices with strong ESG credentials and older stock lacking sustainability and wellness features. HMRC’s commitment to a 460,000-SF regional hub at Pilgrim’s Quarter has boosted confidence in the city centre office market, while demand is holding up relatively well out- of-town.

Although construction has picked up, recent speculative schemes had about 200,000 SF available in mid- 2023. Bank House is helping to alleviate availability constraints in Newcastle City Core, while Sunderland is set to benefit from the Faber and Maker buildings. Insurance giant RSA pre-let 37,000 SF at the former in Q2 2022. The next major scheme to come forward is likely to be The Pioneer, a 100,000-SF wellnessoriented building within the emerging Stephenson Quarter.

Despite low levels of new construction keeping a lid on vacancy, rent growth remains relatively muted. While the market’s best buildings can command increasingly high rents as occupiers seek out the best sustainability and wellness features, owners of offices further down the quality spectrum have begun to adjust rents downwards. Rent growth is expected to remain subdued in the coming years as the office market recalibrates.

Sales volumes have picked up since the second half of last year, though investors remain cautious amid rising interest rates and ongoing market volatility. A handful of notable sales have completed since September’s ‘mini’ budget turmoil including Bank of London and The Middle East’s acquisition of Verisure’s Quorum base for £18.3 million (a 7.7% yield) in Q2 2023. Value players like Praxis remain acquisitive, enticed by a thin buyer pool and softer pricing.

The top office deals completed by Bradley Hall during the second quarter of 2023:

The Yard, Keel Square, Sunderland, SR1 3LH

Price: Undisclosed

Size: 2,540 sq ft

Client: The Ambassador Theatre Group

Unit D13 Marquis Court, 10th Avenue, Gateshead, NE11 0RU

Price: Undisclosed

Size: 10,067 sq ft

Client: Undisclosed

7 Berrymoor Court, Cramlington, NE23 7RZ

Price: £360,000

Size: 2,335 aq ft

Client: Undisclosed

2nd Floor Derwent Point, Clasper Way, Swalwell, Gateshead, NE16 3BE

Price: £29,860 per annum

Size: 2,986 sq ft

Client: BigFoot Networks Ltd

Licensed and Leisure

The North East continues to see strong RevPAR growth, as per half-year results. Room demand is well ahead of pre-pandemic trends and last year’s results, giving hoteliers the pricing power to drive rates and RevPAR, as a result.

As the year started, weekend rate growth slowed considerably, affecting pricing in recent months, but June saw a strong increase in weekend pricing, bolstered by the Rugby Magic Weekend at the start of the month as well as Sam Fender’s sold-out shows at St James’ Park and multiple sell-out concerts at the Stadium of Light. Business on the books looks encouraging, trending ahead of last year, with midweek demand being a key driver, while major events are also supporting performance growth in the upcoming months.

Operators have reported a challenging corporate segment, however, especially within the engineering and manufacturing industries. Companies, such as Nissan and Siemens, are no longer contracting the number of rooms they used to pre-pandemic, making the market more competitive for corporate accounts.

During the period, some sizeable properties opened with over 200 rooms, with the last largest addition to the market being the Maldron Hotel Newcastle with 265 rooms, opened in 2018.

Since then, hotel development has decelerated as the rise in available rooms started to impact RevPAR performance, and the pandemic soon followed. New room supply is not expected until 2024 but will be significant, with one dual-branded project underway—the ibis and Novotel Newcastle Gateshead Quays—adding 327 rooms.

Given the market’s struggles pre-pandemic, hotel sales fell away. Value-add opportunities have driven recent transactions, however, with the sale of the freehold of the Hotel Indigo Newcastle for £13.8 million (£93,000/room) to KE Hotels. The new owner plans to invest in the property, potentially rebranding and repositioning the asset.

While distressed sales have been limited to date, these could increase. The dent left by the pandemic on financial statements coupled with increasing pressures, such as rising operational costs and debt servicing, is set to have an effect on struggling operators and underperforming assets, particularly as a number of loans are expected to mature in the coming months, which could trigger a few sales.

*As reported by CoStar

Sign up to our mailing lists to stay up to date with the latest news here