Much has been made of the UK’s ‘mortgage timebomb’ in recent days and weeks.

Over 1.4 million UK homeowners will see their fixed-rate mortgages expire this year, with rates now more than double what they received two years ago.

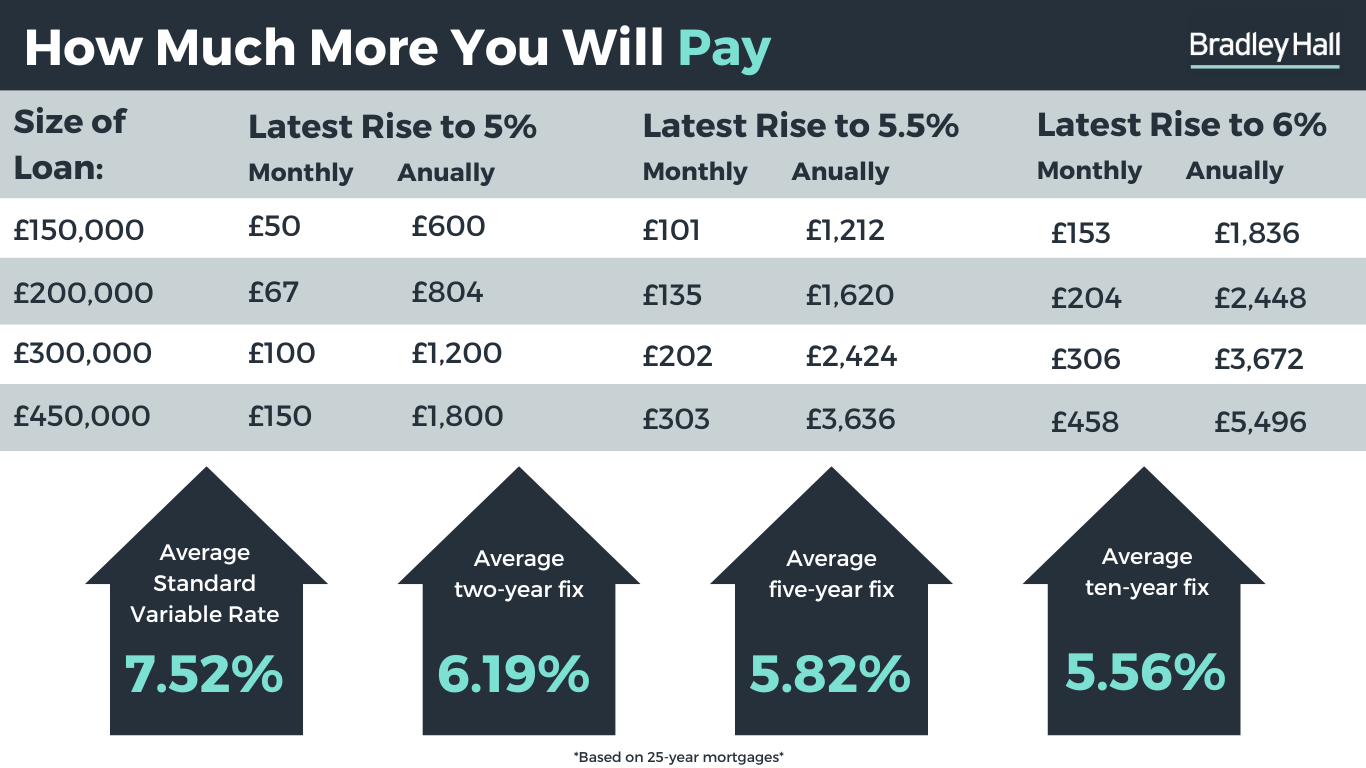

Presently, the average rate for a two-year fixed mortgage sits at 6.19%, more than double the 2021 rate of 2.56%.

For those seeking a new deal, whether they’re a first-time buyer or an existing homeowner, there’s no glossing over it, it’s a bit of a daunting prospect.

However, there are steps you can take to ensure you secure the best deal and make the process as seamless and less stressful as possible, as Chris McVay, Senior Mortgage & Protection Manager at Bradley Hall explains…

Act swiftly

If you’re in the market for a new deal, it’s best to act swiftly as rates are expected to continue rising over the coming months.

Lenders are also continually pulling back their most favourable offers, repricing them every few days, so it’s best to lock in the best deal while you can.

This is especially true for those whose deals are set to end within the next six months.

You can sign up for a new mortgage deal six months before it is due to start, so with rates expected to rise, thinking quick could save you a significant amount of money.

And in the very unlikely event that rates improve before your new deal kicks in, you can always pull out it and enter into a different, cheaper deal, so stand still at your peril.

Explore your options

To ensure you get the best deal for you, it is essential to explore your options. Don't merely settle for your current lender.

Enlisting the services of a reputable mortgage broker could help you save tens of thousands of pounds.

Interestingly, at a rate of 5.82%, five-year fixed deals are currently more affordable than their two-year counterparts too. Another reason why you should explore all of your options.

However, you must also air on the side of caution before committing to a lengthier mortgage agreement. Consider the possibility that interest rates may start to decline within the next year, as predicted by most financial experts. Locking yourself into a longer deal could mean you remain on higher rates for an unnecessarily extended period.

Seek help if you’re struggling

Worried that you may not be able to afford your new bill? Don’t worry, you’re not alone.

According to the Resolution Foundation, a total of five million households are set for average mortgage bill increases of £5,100 by the end of 2024, but support is on hand for those struggling.

By having a chat with your lender – or seeking the support of an adviser – you can seek support in lightening the financial burden. For example, they might present you with some viable options, like extending your mortgage term, which can be quite beneficial.

Consider this: by spreading your repayment period from 25 to 30 years, you can experience a reduction in your monthly payments. Let's say you have a £200,000 mortgage at a rate of 6.19%. Extending it from 20 to 30 years could lead to a monthly decrease of £231, from £1,454 to £1,223.

Of course, it's worth noting that extending the mortgage term does mean you'll pay more interest over the entire loan duration. In fact, the total interest you'll end up paying could increase by £91,342 (assuming rates remain the same). However, don't fret; many lenders are flexible and open to extending mortgage terms, especially for older borrowers, often extending them up to the 70th birthday of the eldest borrower.

Another option worth considering is switching to an interest-only mortgage for a temporary period. This approach can reduce your payments since you'd only be paying the interest on the loan, not the capital. For instance, if you switch from a repayment mortgage to an interest-only mortgage with a balance of £200,000 and a rate of 6.19%, you could potentially lower your payments by £280 per month, from £1,312 to £1,032. However, keep in mind that your lender will likely require you to have a well-thought-out plan for repaying the capital in the long run.

If you're in need of a short-term financial breather, a temporary payment holiday could be an option to explore. Depending on your circumstances and payment history, you might be able to take a break from making mortgage payments for up to six months. Be cautious, though, as not all mortgages offer this feature, and it's crucial to carefully weigh the potential impact on your credit score and future loan prospects. Additionally, keep in mind that interest will still accrue during the payment holiday period.

If you've been diligently making overpayments in the past 12 months, another alternative to consider is underpaying instead of taking a payment holiday. However, it's essential to consult your mortgage provider before proceeding with this option. It's worth noting that if you've been struggling to meet your mortgage payments and have missed some, it's unlikely that you'll be eligible for a payment holiday. In such cases, it's advisable to discuss your situation with your lender to explore alternative solutions.

The overall picture may be bleak, and there will undoubtedly be more bumps in the road, but it’s worth remembering that support is on offer to help those seeking a new deal or looking to get on the ladder.

Afterall, finding ways to financially support the UK’s consumers is crucial if we are to keep the economic wheels of the nation in motion, so seek expert support from an advisor, be savvy and make sure you get the best deal for you.

For more information about mortgages contact the team via mortgages@bradleyhall.co.uk or 0191 260 2000.

BH Mortgage Services Ltd is an appointed representative of The Right Mortgage Limited who are authorised and regulated by the Financial Conduct Authority (FCA) for general insurance, pure protection, and mortgage business. The Right Mortgage Limited is registered in England and Wales. Company No: 09863667. Registered address: John's Court, 70 St Johns Close, Knowle, Solihull, B93 0NH.

*Please note that these rates are changeable and were correct on the date of publishing