Since the start of the Covid-19 pandemic, property prices have risen sharply, in part driven by the Government’s stamp duty holiday.

However, the first half of 2022 has been dominated by a landscape of rising costs for households and significant pressures on personal finances, but this has not yet been reflected through a slowdown in the market.

Supply chain issues, rising costs of materials and labour shortages have all effected the construction industry, and as build costs rise, in turn, so do prices. But the demand from buyers and investors has remained strong leading to continued growth in the sector. ONS House Price Index reported in July that UK average house prices increased by 12.4% over the year to April 2022.

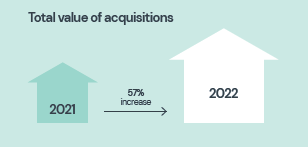

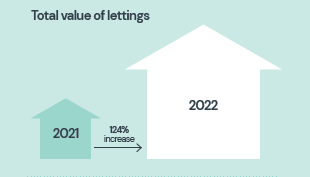

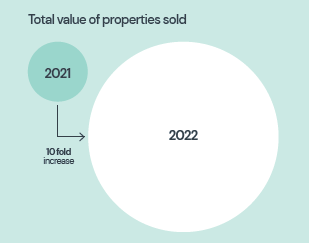

Bradley Hall’s figures for H1 2022 reflect the national property picture with us having rapid growth and seeing transactions almost treble year-on-year. The firm’s sales, lettings and acquisitions for the first six months of 2022 are just under three times as high as the same period in 2021 and across each measure our figures were up.

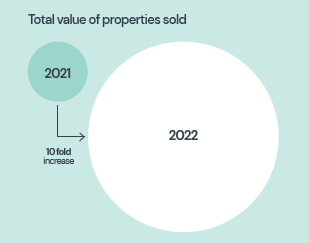

The largest increase was in the total value of properties sold which was ten times higher than H1 2021, however, the other measures also say significant growth, with total value of acquisitions for the period up 124% and the total value of lettings up 57%. The figures follow us breaking our own record by closing deals worth over £160m during the 12 months to May.

Recent deals have included acting on behalf of Persimmon Homes on the sale of 26 affordable homes in Ashington; supporting Northern Commercial Properties sell land to Premier Inn Hotels for a new venue in Alnwick; and successfully letting Four Market Place in Morpeth to Tomahawk Steakhouse on a ten year lease.

There has definitely been something of a boom in the region’s property market over recent months, with a mix of limited supply and increased demand leading to a sustained period of growth. Confidence in the region is very high among investors at the moment.

Everyone knows the strains there are on personal budgets and this could worsen over the coming months, however, even if there is something of a slowdown, the North East property market is resilient and Bradley Hall suspect any downturn will be less palpable here than in regions further south.

The North of England is one of the best places to invest and we would really recommend anyone considering investing in property to consider the area.

Such growth in deals year-on-year also highlights the strides the company has made in recent years. We have made it clear that we want to be a driving force for positive change in the North and the levels of growth the company is demonstrating shows we are definitely on the right track. We are keen to play a part in creating and protecting thousands of direct, indirect and induced job opportunities across the region and beyond.

The prevailing opinion is that the UK economy is heading into a period of significant turbulence, and possible recession, in the coming months. Persistent supply issues, soaring inflation and the cost of utilities all having a significant dampening impact on the economy.

It is likely that this will lead to some sort of slowdown in the property market, which has sustained huge growth through very challenging economic conditions, however, it is unlikely that this sector can remain uninhibited by the wider economic strife. But there is a resilience to the market that should place it in a good position to ride out the forthcoming economic challenges.