As the country emerges from lockdown and summer arrives we have quite literally been greeted with sunshine and warm weather, while some children return to school and many adults go back to work.

At Bradley Hall we have certainly realised that as lockdown has eased and with the introduction of the new normal, our clients have returned energised, keen to catch up on lost time and deliver on projects which have been put into hibernation since March.

Across our network of estate agency branches we continue to progress the sales that had been paused and have been inundated by a new wave of buyers as those lost to the market from March through May have returned. Indeed, Rightmove recorded 10 of its busiest days in May and June and our own analysis shows June to have seen higher enquiry levels than the same point last year.

This positive picture has resulted in an imbalance in the equilibrium between buyers and sellers and, so far, indicated only negligible impact on offers being received. As we move forward, we will now watch to see how this relationship rebalances into July and August.

Given what we have seen in recent weeks, the question I am now most commonly asked by clients across the residential sector is how property prices will be impacted by the Covid-19 pandemic in the medium term. Clearly, downside risks remain as the country emerges further from lockdown and the impact on the economy can be assessed. While we are seeing pent up demand and localised factors influencing the market in the short term. Over the medium term wider macroeconomic factors will once again be the key influences on market performance and attention will turn to employment rates (does unemployment rise as furlough is wound down?), interest rates (can record low levels be sustained?) and wage inflation (does the affordability gap widen?).

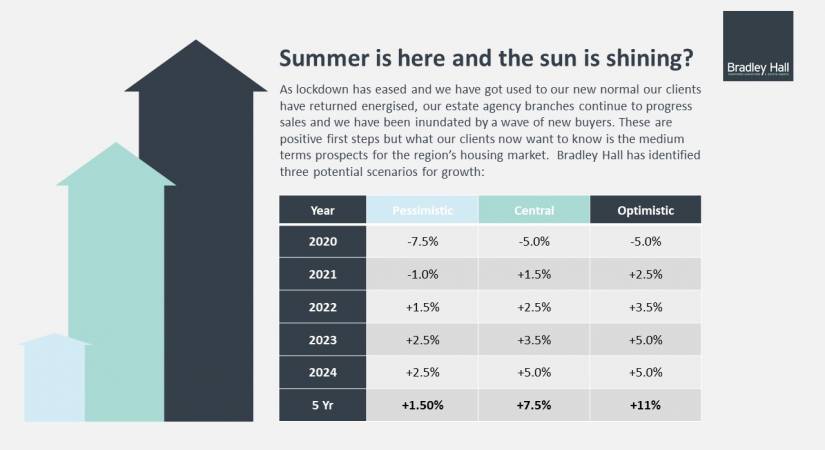

Bradley Hall has looked into how we expect our markets to change over the medium term looking at a variety of factors including forecast changes in GDP, interest rates, inflation and employment as well as also looking at the expected delivery of new homes in the region, a key catalyst of market activity. Combined, this has given us three working scenarios - pessimistic, central and optimistic.

Our pessimistic scenario assumes 5 year growth of 1.5% as a result of furlough being wound down leading to a marked upturn in redundancies and unemployment, the government takes limited steps to intervene directly in the residential property market and businesses respond significantly reduce investment as a result.

Our central scenario assumes 5 year growth of 7.5% with current activity slowing down through July and August and failing to pick up further during the Autumn, business and the public take a ‘wait and see’ approach before beginning 2021 more optimistically as the wider economy begins to recover.

Finally, in our optimistic scenario, our 5 year growth expectation is 11% as market equilibrium returns quickly while government makes interventions to maintain low interest rates, support construction and boost demand (e.g. extending help to buy).

Overall, we watch and wait to see where we will fall on these scenarios but we can at least take confidence initially from how the market has recovered as lockdown has eased and, with a strong summer, we continue to remain optimistic that the region’s housing market will see plenty of sunny days ahead.

[Important Note: This article is provided for general information only and must not be published, reproduced or quoted without the express permission of Bradley Hall Ltd. It should not be used to form the basis of any report, prospectus or transaction and no liability is accepted by Bradley Hall Ltd for decisions made based on this article].